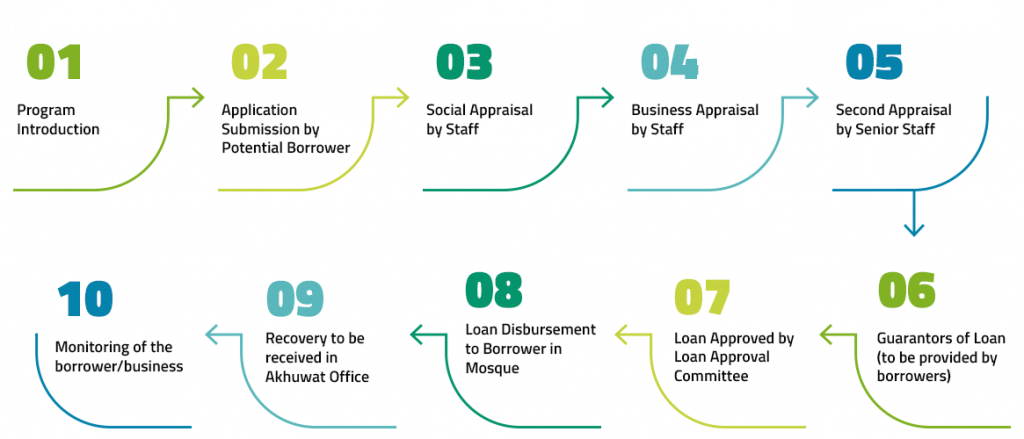

Loan Process

Eligibility Criteria for Loans

Following general points are compulsory for eligibility of loan:

Applicant should have valid CNIC.

Having the ability to run / initiate business activity having age between 18-62 years.

Applicant should be economically active.

Applicant should not be convicted of any criminal offence in lieu of which proceeding are in progress.

Applicant should have good social and moral character in his community.

Applicant should have capacity to provide two guarantors other than family members.

Applicant should be resident of operational area of branch office which might be around 2-2.5 KM radius.

Note: – Project specific eligibility criteria may be varied.

Lending Methodology

AIM’s lending policy involves disbursement of interest free or Qard-e-Hasan loans through Group Lending

Individual Lending

However, decision of lending methodology depends upon the loan product as well as project specific requirements.

Group Lending

Group Lending includes disbursement of Qard-e-Hasan loans among groups of men and women who are looking forward to enhance their family income but are unable to do so due to scarce resources. In group lending methodology groups of 3 to 6 members will be formed, all group members would guarantee loans and credentials of each other. Group Lending enables group members to resolve their social and economic problems through mutual understanding and decision making.Before applying for a loan, applicant is supposed to constitute a group of 3 to 6 members residing nearby to each other and members shouldn’t be close relatives to each other.

Individual Lending

Individual Lending includes disbursement of Qard-e-Hasan loans among individuals. Loans are offered to certain individuals that fulfill the eligibility criteria of scheme in order to facilitate them to meet their needs through interest free loans. In case of individual lending two guarantors will be provided by applicant for availing interest free loan.

Application Submission

The loan process will start with the submission of application. The application fee may vary from scheme to scheme. The unit manager will then evaluate the application through eligibility criteria. Thus, these loans will be given out on social collateral. The following steps will be followed in application submission.

Applicant will visit nearest AIM branch along with his/her relevant documents (mentioned below) for submission of loan application.

Unit manager will discuss with the applicant to check whether applicant falls under eligibility criteria of the scheme.

Potential candidate will submit loan application on prescribed form. Loan application will be provided and filled by AIM staff in branch office.

Unit manager will check documents and application will be processed after completion of required documents.

The following are the details of collaterals that may be applied for loans:

1. Personal responsibility

2. Two guarantors

3. Postdated cheques

4. Any additional collateral in special case.

Following documents shall be submitted along with loan application:

Copies Of CNIC

Applicant (Mandatory)

Guarantors (Mandatory)

Family Member (Optional)

Objective

For Identification

For verification in Management Information System (MIS)

Bank Requirement for collecting money

Latest Utility Bills

Applicant (Mandatory)

Objective

For address verification

To assess Payment Behavior

Latest Photos

Applicant (Mandatory)

Objective

For identification

Copy of Nikahnama

Applicant (Mandatory) (may be waived if not available after verification by other means)

Objective

For identification in case CNIC of wife is not with the name of husband

Note: – Additional documents may be demanded according to scheme’s requirements.

Social Appraisal

Social appraisal aims to verify character and credibility of the applicant by visiting his residential place. After receiving the Application, unit manager performs social appraisal through following methods.

Information from existing borrowers

From the living style of the applicant

Views of neighbors about the applicant

Personal interview/ family interview

Business Appraisal

Through the scrutiny of business plans the business idea of the intended borrower will be evaluated to see if it is viable and whether it can generate income beyond the household expenses sufficient for loan repayment. Business requirement is evaluated in business appraisal. This will also help fine-tune the applicant’s business idea itself. The applicant’s family will also be interviewed to make sure that they know about the loan and support the business idea.

Second Appraisal:

After initial appraisal by the unit manager, the application will be forwarded to Branch Manager who will appraise the social and business appraisal process once again and conduct a meeting with borrower and their guarantors.

Fund Request & to head office

Once loans are approved by the LAC, the required amount of funds is requested to the Head Office through the Regional Manager. The head office makes necessary arrangements for transfer of funds.

Loan Disbursement

Disbursement takes place once a month and loans are distributed through an event usually held at a mosque or church. In case the individuals, lending applicant has to be accompanied by at least one guarantor. In case of group lending, all group members are to be present at the time of disbursement. Funds are transferred through Cash Over Counter (COC) facility, where beneficiary will visit the counter of concerned Bank and will receive the money. However, disbursement may also be made by direct transfer of money into respective bank account of beneficiary depending upon the nature of the project and amount of the loan. For disbursement purposes, any other verifiable mechanism may be adopted on the discretion of the AIM.